Ralphael50

New Member

- Joined

- Jul 12, 2020

- Messages

- 6

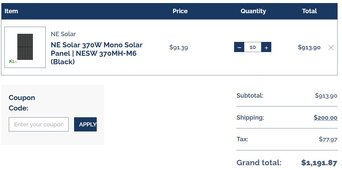

I just learned that Signature Solar is now taxing customers in Florida. Did any laws change in the new year so that that they now have to tax Florida customers?

Florida is going downhill so of course they're going to need all the money they can get.

I just ordered some panels from them few days before end of the year. Lucky me lol.

She's a lady!

@SignatureSolarJess Can you comment? It does not look like solar panels are subject to sales tax in FL.I just learned that Signature Solar is now taxing customers in Florida. Did any laws change in the new year so that that they now have to tax Florida customers?

It looks like this was updated on Monday. I am looking into this further but it does look like we have to tax Florida customers.I just learned that Signature Solar is now taxing customers in Florida. Did any laws change in the new year so that that they now have to tax Florida customers?

Thanks. Could you find out the reason for this change? I can't find any recent laws that made solar components subject to sales tax again.but it does look like we have to tax Florida customers.

I will absolutely see what I can find out for you!Thanks. Could you find out the reason for this change? I can't find any recent laws that made solar components subject to sales tax again.

As a former retailer I can tell you, the one thing you definitely don't want to get wrong is sales tax. They will come after you with a vengeance. So as a business, it is a lot safer to charge the tax. As a consumer, you can get remedy from your state if needed.Home Depot is not charging tax on solar panels. Other sites I checked are not charging tax on EG4 batteries. I'm curious on why SS started charging tax.