Does any of the EG4 mini splits qualify for the Federal tax credit? My understanding is it has to be energy star labeled. This is from the government website, “All heat pumps that have earned the ENERGY STAR label” qualifies. Do the solar mini splits qualify? Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EG4 mini split

- Thread starter BKY2003

- Start date

Sundog33

Sun Bather

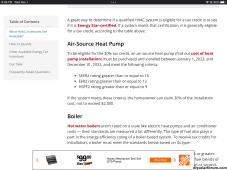

Last year when I was looking in December Signature Solar used to have a link to the government rebate program.

and implied that the mini splits were included.

I would hope that would be the case as a 22 Seer qualifies over the 15 Seer threshold.

When the new form is released only way to know for sure. Attached is the certificate on EG4 site

and implied that the mini splits were included.

I would hope that would be the case as a 22 Seer qualifies over the 15 Seer threshold.

When the new form is released only way to know for sure. Attached is the certificate on EG4 site

Attachments

Last edited:

Sundog33

Sun Bather

Sundog33

Sun Bather

Well. I filled out my taxes. Claiming this as a geothermal pump because it does heat too

I claimed the mini split, solar panels, cable, shut off and all hardware. I also added the Pecron E2000 because I have it wired up to take the Ac power part from the Pecron

I believe it qualifies . If so it gave me $1200 bucks back.

If they bitch I will have to split it up between solar and a/c credits. But I think it will be fine.

I claimed the mini split, solar panels, cable, shut off and all hardware. I also added the Pecron E2000 because I have it wired up to take the Ac power part from the Pecron

I believe it qualifies . If so it gave me $1200 bucks back.

If they bitch I will have to split it up between solar and a/c credits. But I think it will be fine.

Partimewages

Solar Addict

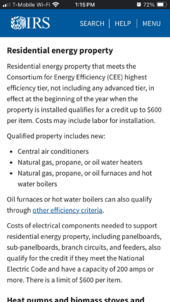

It would qualify as an air source heat pump but not a geothermal/ground source heat pump.

Sundog33

Sun Bather

Your guess is as good as mine.

Signature Solar advertised the rebate on their site for it.

We’ll see I bet I’ll get the rebate. Since Trump fired half the IRS. No one cares.

Signature Solar advertised the rebate on their site for it.

We’ll see I bet I’ll get the rebate. Since Trump fired half the IRS. No one cares.

timselectric

If I can do it, you can do it.

- Joined

- Feb 5, 2022

- Messages

- 18,766

Hopefully they didn't advertise it as qualifying as a geothermal. (Because it's not)Signature Solar advertised the rebate on their site for it.

You will probably get the rebate.We’ll see I bet I’ll get the rebate. Since Trump fired half the IRS. No one cares.

It's only going to be an issue if you get flagged for an audit.

Which can happen anytime in the next 7 years.

Sundog33

Sun Bather

You’d have to read the fine print. The rebate may include high efficiency heat pumps.

I’ll take a look again before I ship it

I’ll take a look again before I ship it

Plum Crazy Rob

Solar Enthusiast

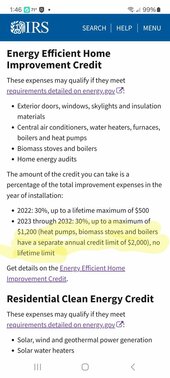

WHY would you claim it as Geo anyway?? I thought I remember Geo or air source was 30% either way, though Geo is lumped into "Clean Energy" with Solar, and air source in "HIGH Efficiency Home Improvements"

Haven't relooked, I got a refund so filed taxes the first day the updated form 5695 was available in February. Make sure you have the right form!! The prior year is VERY WRONG vs IRA updates this year!

Haven't relooked, I got a refund so filed taxes the first day the updated form 5695 was available in February. Make sure you have the right form!! The prior year is VERY WRONG vs IRA updates this year!

Plum Crazy Rob

Solar Enthusiast

With that said, it's only a technicality not a financial error, so yeah even the IRS probably gives 2 sh!ts about it.

peakbagger

Solar Enthusiast

- Joined

- Oct 26, 2021

- Messages

- 309

Keep in mind the much more lucrative IRA rebates (for some folks) are not retroactive and depends on individual states setting up rebate program that meet and are approved by the DOE. https://www.nrcs.usda.gov/about/pri.../inflation-reduction-act-investments-by-state

Very few if any states are actually ready to process the paperwork and since its not retroactive any money spent prior to the start of the state program does not qualify.

Keep in mind the state programs may give a sh*t far more than the IRS.

Very few if any states are actually ready to process the paperwork and since its not retroactive any money spent prior to the start of the state program does not qualify.

Keep in mind the state programs may give a sh*t far more than the IRS.

Sundog33

Sun Bather

It’s not a state program.

I use Turbo tax that has all the latest forms

From what I saw the A/C credit was only 20%

I’ll have to pull it up again and look

I use Turbo tax that has all the latest forms

From what I saw the A/C credit was only 20%

I’ll have to pull it up again and look

Sundog33

Sun Bather

Sundog33

Sun Bather

Maybe I can claim the panels on a different rebate. I’ll have to rerun it

But panels I thought you can only do one time and I have claimed them previously

Well see

But panels I thought you can only do one time and I have claimed them previously

Well see

Sundog33

Sun Bather

Still can’t complain I was looking at a $4200 rebate with a kid in college and a business. I can handle the $600 hair cut

Q-Dog

¯\_(ツ)_/¯

Correct, you can only claim solar equipment once, and only after it is put into service. If you add more solar panels, inverters, batteries, you can claim them.Maybe I can claim the panels on a different rebate. I’ll have to rerun it

But panels I thought you can only do one time and I have claimed them previously

Well see

So if I add more batteries and panels then it can’t be claimed? Only the first system.Correct, you can only claim solar equipment once, and only after it is put into service. If you add more solar panels, inverters, batteries, you can claim them.

HalfBaked

Ever the student

If you add more solar panels, inverters, batteries, you can claim them.

Plum Crazy Rob

Solar Enthusiast

Plum Crazy Rob

Solar Enthusiast

@peakbagger is talking about upcoming State IRA rebate programs which are still being worked thru the paperwork hoops.

And, of course disclaimer,

Please consult your tax advisor

And, of course disclaimer,

Please consult your tax advisor

Similar threads

- Replies

- 1

- Views

- 319

- Replies

- 6

- Views

- 553