You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

30 Percent Tax Credit ?

- Thread starter kendive

- Start date

chrisski

Solar Boondocker

- Joined

- Aug 14, 2020

- Messages

- 5,192

So, electric cars are not fueled by coal power?Let's not troll on this forum?

A simple google search shows a nuanced answer: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.phpSo, electric cars are not fueled by coal power?

cs1234

Solar Wizard

- Joined

- May 9, 2022

- Messages

- 2,302

So, electric cars are not fueled by coal power?

Duh. They can be fueled by something as pretty as a watermill too. They are kind of versatile. Some people here on the forum, like @Will Prowse , even fuel theirs using home harvested solar, pretty much exclusively.

Ampster

Renewable Energy Hobbyist

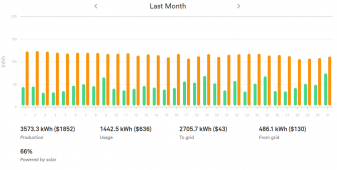

Some probably are. Mine are fueled by solar from my roof and occasionally, when travelling, from mostly renewable energy during the day. California purchases little or no coal generated electricity, so it is safe to say in California that electric cars are most likely not fueled by coal power. Since California has a higher EV adoption rate than other states it is likely that the majority of EVs in the US are probably not fueled by coal.So, electric cars are not fueled by coal power?

You will get better traction for those views on Solarpaneltalk.

Last edited:

Risky Rob

Solar Enthusiast

So the $739 Billion Inflation Reduction Act of 2022 was about solar power?Gee Republicans against solar-who new?

Not against solar. Against government waste. You cannot spend your way out of inflation. And we don't need tens of thousands of new IRS agents shaking us down for every last penny we got. Especially not heavily armed ones - since when does an IRS agent need to be willing to use deadly force?Gee Republicans against solar-who new?

I wonder what color crayon was used.Biden signed it.

Ozark Tinkering

Solar Addict

- Joined

- Dec 23, 2021

- Messages

- 1,109

Yes it includes anything you would otherwise get 26% for in 2022 is now worth 30%. I'm still working on credits from 2021 so I'm in no hurry in that regard. I'm just glad they didn't put the same Made in America stipulation to qualify for the credit as they did with EVs.Will it cover 2022? I have already maxed out my tax liability with the 26% credit for this year. This might be justification to buy more panels.

Ozark Tinkering

Solar Addict

- Joined

- Dec 23, 2021

- Messages

- 1,109

Well it sure weren't ORANGE.I wonder what color crayon was used.

Ozark Tinkering

Solar Addict

- Joined

- Dec 23, 2021

- Messages

- 1,109

Probably the day after the Saint Valentine's Day Massacre and they went after Al Capone would be my best guess?since when does an IRS agent need to be willing to use deadly force?

Whiskey RebellionProbably the day after the Saint Valentine's Day Massacre and they went after Al Capone would be my best guess?

Government spending causes inflation.Not against solar. Against government waste. You cannot spend your way out of inflation. And we don't need tens of thousands of new IRS agents shaking us down for every last penny we got. Especially not heavily armed ones - since when does an IRS agent need to be willing to use deadly force?

Goboatingnow

Solar Enthusiast

- Joined

- Jul 3, 2022

- Messages

- 1,325

Taxes are neccesssry to run services that contribute to the public good , welfare , Heath services , police , education, roads , (/and grants to incentivise certain behaviour or activity ) etc etc etc. Since you benefit from the society so created , ie your kids get schooled, the police keep the neighbour hood safe , you get medical care etc it’s not stealing.It is not a grant. They are giving you nothing. Just stealing less from you when you file.

Grants are ways to distribute tax takes in a biased way to achieve certain societal goals , in essence you receive a part of someone else’s tax in some cases.

Whatever it is it’s not stealing

Then a good thing this bill reduces the deficit by spending less than it raisesGovernment spending causes inflation.

Goboatingnow

Solar Enthusiast

- Joined

- Jul 3, 2022

- Messages

- 1,325

Government spending causes inflation.

The fact that levels of inflation not seen in decades came after historic amounts of government assistance has focused attention on the role that government spending plays in producing inflation. Opinions of scholars of economics are mixed on this question.

Some studies of the historical record suggest that government spending has no effect on inflation. Others find that it has some impact on inflation but is likely only partially responsible for the post-pandemic inflation spike. One study, for instance, suggested that government spending had contributed 3% of the increase in inflation.

Inflation’s root cause is demand outstripping supply. Many factors go into either increasing demand or reducing supply. For instance, when interest rates are lower, businesses and consumers find it easier and cheaper to borrow, which can spur increased demand. From the other direction, when supplies shrink significantly even though demand stays constant, as is particularly often the case with oil, inflation can also occur.

Economists also have not agreed on the mechanism by which increased government spending boosts inflation. Some suggest this happens because bond buyers witnessing increases in federal government borrowing lose faith in the government’s ability to repay its debts. A more conventional explanation is that when consumers and businesses have more money, as they did following the COVID-related stimulus spending, they buy more, which prompts businesses to raise prices to manage demand.

Many other factors can also influence the inflation trend. They include interest rate fluctuations, labor market changes, alterations in supplies of key commodities and more. The inflation run that began in 2021 was powerfully affected by a sudden rebound in depressed consumer demand as the pandemic eased, coupled with shortages of many items brought about by global supply chain disruptions.

I agree that the causes of the current world-wide inflation are complex and not entirely due to the last administration's massive deficits.The fact that levels of inflation not seen in decades came after historic amounts of government assistance has focused attention on the role that government spending plays in producing inflation. Opinions of scholars of economics are mixed on this question.

Some studies of the historical record suggest that government spending has no effect on inflation. Others find that it has some impact on inflation but is likely only partially responsible for the post-pandemic inflation spike. One study, for instance, suggested that government spending had contributed 3% of the increase in inflation.

Inflation’s root cause is demand outstripping supply. Many factors go into either increasing demand or reducing supply. For instance, when interest rates are lower, businesses and consumers find it easier and cheaper to borrow, which can spur increased demand. From the other direction, when supplies shrink significantly even though demand stays constant, as is particularly often the case with oil, inflation can also occur.

Economists also have not agreed on the mechanism by which increased government spending boosts inflation. Some suggest this happens because bond buyers witnessing increases in federal government borrowing lose faith in the government’s ability to repay its debts. A more conventional explanation is that when consumers and businesses have more money, as they did following the COVID-related stimulus spending, they buy more, which prompts businesses to raise prices to manage demand.

Many other factors can also influence the inflation trend. They include interest rate fluctuations, labor market changes, alterations in supplies of key commodities and more. The inflation run that began in 2021 was powerfully affected by a sudden rebound in depressed consumer demand as the pandemic eased, coupled with shortages of many items brought about by global supply chain disruptions.

Similar threads

- Replies

- 2

- Views

- 198

- Replies

- 6

- Views

- 229

- Replies

- 5

- Views

- 433