SignatureSolarJess

Online Engagement Specialist

- Joined

- Nov 21, 2022

- Messages

- 448

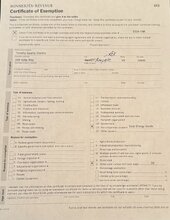

I will absolutely see what I can find out for you!Thanks. Could you find out the reason for this change? I can't find any recent laws that made solar components subject to sales tax again.