Indeed.

@frasere2, read from

this post onwards. The IQ8HC will max out when the panels are operating at 86.3% of their efficiency. First, they'll never operate at 100% efficiency, and probably closer to 80-90% maximum given their orientation. Second, they degrade over time, so even if there

is any excess above the microinverters' limit, this will likely be temporary per the degradation graph after some years. The effect on the ROI therefore will be reduced. That's my qualitative assessment anyway.

I haven't crunched any numbers on this, but the numbers seem roughly in the ballpark enough to not need to.

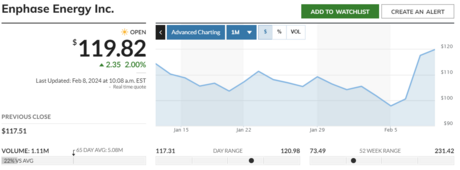

As for all the speculation on stocks and job cuts and 25-year warranty, I think it's an academic discussion. Every major corporation has made job cuts including all investment banks and big tech companies like Google, Amazon, Meta, etc. It doesn't necessarily indicate anything negative about a company. It often means they are realigning, restrategising, and potentially shifting focus. For example, cutting back on sales or engineering, and shifting focus towards R&D, or vice versa. This especially happens when a company has experienced significant growth. This must taper off, and usually comes with job cuts (but also hiring in other departments which often isn't mentioned in the news articles). So, any speculation about Enphase on this point is mostly that. Stock prices will reflect the market sentiment only. And as

@OffGridForGood alluded to, volatility or dips/peaks are more an opportunity for investors than a problem for a company. They're just sell-offs or taking profit ahead of a lull, especially after strong growth and before realignment/restrategisation. It's only when a company fails to sustain itself with new business, markets, or innovation does it fail. And I don't see any indication of that from Enphase. At worst, they'll be taken over, but it's impossible that millions of users' equipment would be rendered useless by a company failure. Governments, regulators, and big industry players would simply prevent that for a whole multitude of reasons I'll not go into here.

As for whether the 25-year warranty will be worthwhile in 20+ years, it's hard to say. But what it does offer is a confidence level in the quality of the equipment. No large corporate with regulated engineering and supply chains would offer this without substance.