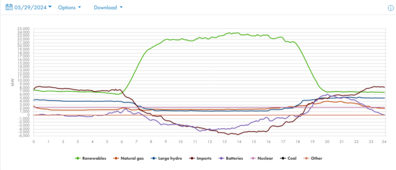

Perhaps the most interesting part, the "Battery" source is shown about the same cost per kWh as the Nat. Gas source.

That would be because the wholesale price for all generation sources for each 5-minute interval is set by the last least cost bidder to fill the demand requirement, which will pretty much always be gas at the time a battery is discharging.

We have no idea how they calculated the 'cost per kWh' for the batteries, the rate may already take account of recycle -end of life cycle costs.

I wouldn't want to assume either way.

It's the weighted average value of the wholesale spot price and energy discharged.

e.g.:

If in one interval the spot price is $100/MWh and they discharge 1 MWh, then in that interval the battery earns $100.

Then the next interval the spot price is $200/MWh and they discharge 2 MWh, then in that interval the battery earns $400.

Total energy discharged: 3 MWh

Total income: $500

Average discharge value: $500 / 3 MWh = $166.67 / MWh.

That would be the basic process for calculating the average price over an hour, day, week, month, year etc. Weighted average value over all the intervals in which they discharged energy.

Note however that supply of energy to the spot market is not the only way grid batteries earn income. They also provide frequency control and ancillary services (FCAS), which is a separate market to energy generation.

FCAS is the rapid response mechanism for helping ensure grid stability and the grid operator pays for those services. Batteries have completely eaten gas's lunch in the FC market and it is where many of them make most money. Batteries can do this better and way faster than gas reserve power plants can. Gas used to make an absolute motza in this space, not so much anymore where batteries are operating and the grid cost savings have been substantial. They also earn income as the grid operator pays for a reserve capacity (which they would also do with other generation sources but it adds more competition in that space previously dominated by gas plants).

Wait till they have to "recycle" those batteries. See what the electric rates are then.

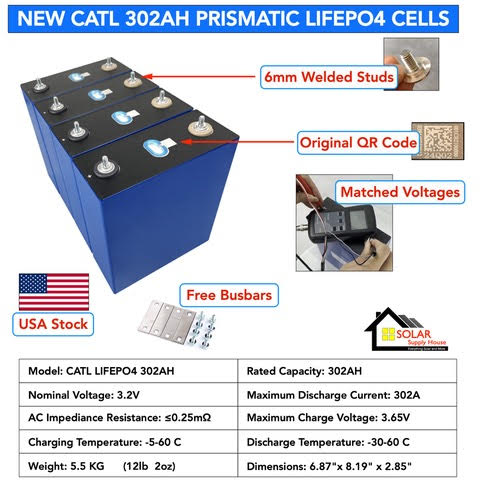

The large batteries in operation on the grid here so far are paying for themselves very quickly, which is why they are being installed quite rapidly. After 20 years their replacement cost will be negligible relative to their cash flow value. I expect in reality that grid batteries, being so modular in design, will be replaced module by module as and when it makes sense. They are like a shipping container which can be lifted in/out of its slot. A bit like one might replace one server rack battery in their home battery rack, except on a much larger scale.

As to recycling, lithium batteries are highly recyclable and will have quite a decent scrap value, and this will be even more the case in the years ahead as they will contain a exceptionally high grade of material for reprocessing - material that will be in high demand for decades to come.

Yes, if you're on a variable tariff, you get paid to use it (or it just gets deducted from your final bill).

The flip side of that is rates for exporting energy to the grid also fall. Credit rates for exporting here have been declining for years and that will continue. We are in the 2-5 US cent/kWh range for export credit.

If you are on a wholesale cost pass through plan then exporting energy when the price is negative will cost you, so naturally it helps to only be on such a plan if you have the ability to automatically curtail exports based on the market price signals. That's certainly doable now if you have the right equipment (e.g. I could adjust my Fronius inverter's export setting via modbus control). Not that I export much as our self consumption rate is pretty high.

opennem.org.au