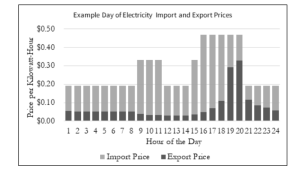

That’s based on the graph indicating 2.5 cents for export over midday hours versus off-peak retail rates of 19 cents.

I’m not understanding your conclusion. PV costs per W of panel power keep getting cheaper and cheaper. You can install a 150% sized array today for less than you could install a 100% sized array even ten years ago (same number of panels, just 1.5 times as powerful).

Without battery, or battery full and exporting power, we get 2.5 cents credit per kWh.

Assume someone pays $3/W for an installed system. Amortized over 20 years, that's about $0.075 per kWh produced.

This saves money vs. buying from grid, if consumed without the house and not exported to grid.

But if the kWh is exported, they get $0.025 credit. Then when they import a kWh, they pay $0.19, for $0.165 net charge on bill.

In addition to the bill, it cost them $0.075 to produce that kWh, total $0.24 cost for 1 kWh consumed.

$0.24 > $0.19, would have been better of without PV, just buy from the grid.

Installed 150% of consumption? Consider 1.5 kWh exported, credit $0.0375

Import 1 kWh, pay $0.19, for $0.1525 net charge on bill

PV cost them 0.1125, total $0.2650 for 1 kWh consumed

If export is credited $0.025, you break even with DIY PV, which costs $1/W and $0.025/kWh.

If you pay for installation, total > $1/W, then producing power costs more than $0.025/kWh and you lose money by exporting.

Once you can afford to install an array sized to generate 100% of monthly consumption over winter months, who cares what credit you get for export of summer overgeneration? It’s still better than you’d get being totally off-grid?

Credit of $0.025/kWh is better than nothing (assuming no added fixed charges), better than curtailing production when off-grid system has full battery.

If you mostly use what you produce at the moment of production, oversize PV could be useful because it covers more of peak consumption, saving you from paying $0.19/kWh for those peaks. At the cost of wasting more production for $0.025 credit when your loads are less. With self-install cost of $0.025/kWh produced the point where returns diminish to zero is about when 7 or 8 additional kWh/day of panels saves you from buying 1 additional kWh from grid during your peak consumption. For turnkey install cost of $0.075/kWh, diminishing to zero returns about 2 or 3 additional kWh/day of panels to avoid importing 1 kWh during peaks.

You need to check the specific specifications of your smart meter, but in general, you should assume instantaneous tabulation (dual-channel). Export tabulated separately from import.

I don’t see how it changes the math unless the community solar also incorporate a big enough battery to offset overnight consumption.

Community solar is/was credited to your account in some manner.

If it credits you $0.025/kWh and you are simultaneously charged $0.19, there is little value. Merely break-even if community solar costs $1/W installed, therefore not worth doing.

If, however, 1 kWh of community solar offsets your meter's record of 1 kWh consumption, then you come out ahead.

That could be done under net metering, because 1:1 credit. But what is done under NEM 3.0?

You may or may not want to buy a battery to ride through the night. Where NEM 3.0 will screw people over is loads that toggle on and off.

Consider a PV system exporting 2kW, and a dryer that draws 4kW and switches on/off with 50% duty cycle. Half the time, net draw is 2kW, costing $0.19 x 2 = $0.38/kWh. Half the time net export is 2kW, credit $0.025 x 2 = $0.05. Net charge is $0.14 per hour.

If you have a battery being controlled for zero export, zero import, PV supplies 100% of dryer's consumption, zero credit zero charge.

Continuously variable consumption by appliances would be another approach.

But bolting a battery to the side of the house and attaching CT is a standard product that will work for everyone.

In the end, it accomplishes nothing different from net metering, or aggregating a few dozen neighbors and tracking net import/export for the neighborhood.

I think but don't know that San Jose Power, a virtual power company which sells power to and credits for power from homeowners, might be able to skim the windfall that NEM 3.0 gives the utility. But probably not, will be required to pay transmission costs to PG&E for each house that imports at any given instant.

If a condo complex or apartment building installed a single meter where utility feeds power to the property, and did its own metering of individual units, then it would get the benefit.